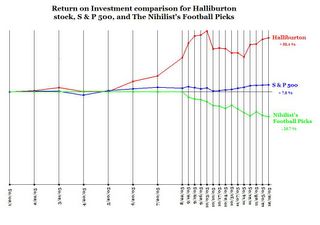

On George Bush’s Inauguration Day, January 20, 2005, I purchased 100,000 shares of Halliburton at $41.62 in an attempt to cash in on the war. That investment has been a major success with Halliburton closing at 65.94 on Tuesday.

But how does Halliburton’s return compare to other possible investments? Let’s compare it to two common benchmarks: The S&P 500 and the Nihilist’s football picks.

First Halliburton:

My initial investment of $4,160,000 is now worth $6,594,000, a profit of $2,434,000 or 58%.

An equal investment in an S&P 500 Index fund would now be worth $4,487,832.89, a profit of $327,832.89 or 7.8%.

An investor betting $37,160.71 on each of the Nihilist’s weekly football picks, plus the same amount on each parlay, would have bet a total of $4,160,000. That investment would now be worth $3,050,556.82, a loss of $1,111,433.18 or -27%.

The chart below demonstrates just how brilliant I was to invest in Halliburton as opposed to the other options. (Although, note that an investment in the Nihilist’s football picks does break even before the football season starts.)

0 Comments:

Post a Comment

<< Home